Failing to file payroll taxes is a costly mistake. However, it is possible to avoid pitfalls by keeping your records organized and taking advantage of the various available deductions and credits.

Small business owners can also reduce tax liability by accelerating income into the current year. This strategy is especially beneficial for businesses that anticipate future tax increases.

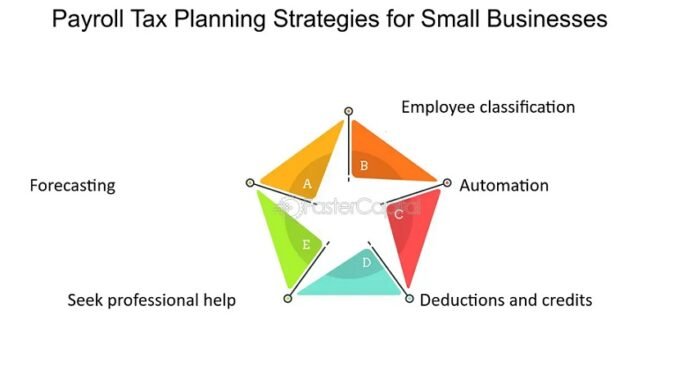

Forecasting

Payroll taxes are a significant cost for small businesses. These taxes are used to fund employee social security and medicare benefits. They are also required for state and local tax purposes. Proper payroll taxes for small businesses are essential. Companies can minimize payroll taxes and avoid costly mistakes by keeping accurate records, understanding employee classification, staying up-to-date on tax laws, filing the correct forms, and seeking professional help.

Forecasting is a decision-making tool that allows managers to project future revenue and expenses. It can be done in two ways: judgment-based and quantitative. The latter uses historical numerical evidence to predict future trends. Gathering data requires more time and effort but is considered a more reliable method.

In addition to forecasting, small businesses should consider using deductions and credits to reduce their overall tax liability. Several options include hiring family members, implementing HSAs, and investing in qualified retirement plans. In addition, companies should be sure to remit all necessary payments on time. Failure to do so can result in substantial fines and penalties.

Employee Classification

Proper classification of employees is crucial in determining the amount of payroll taxes a company must pay. Misclassifying an employee as an independent contractor instead of an exempt employee can result in significant fines. Employee classification involves assessing job responsibilities and other factors to determine their proper designation. It is important to take the time to carefully review this information to ensure compliance with labor laws and avoid costly mistakes.

Generally, federal law classifies workers based on their economic dependence and whether they qualify for overtime pay. State and local laws also impact classification to determine access to certain benefits.

As a small business owner, you must ensure that all your employees are properly classified. This guide will help you avoid unnecessary taxes and penalties by leveraging automation, staying current with tax laws, and seeking professional assistance. By making these adjustments, you can minimize your tax liability and improve the financial success of your business. If you are uncomfortable handling payroll tax planning alone, a payroll service can provide a comprehensive solution.

Automation

One of the small businesses’ most common mistakes is improperly managing their tax obligations. This can result in financial penalties and time-consuming audits. Consider implementing automation in your payroll tax planning strategy to prevent such errors.

Process automation replaces manual tasks with computer software programs that execute activities. This approach has numerous benefits, including reduced labor costs and avoiding costly human errors. It can also reduce the time spent on administrative tasks and free up employees’ time for more valuable work.

Business owners should stay current on tax regulations to ensure compliance and maximize deductions and credits. They should seek professional help when preparing and filing taxes to minimize liability. Additionally, they can consider several strategies to reduce payroll taxes, such as adjusting their employee compensation structure or hiring family members. This can reduce their taxable income by sheltering earnings from Social Security and Medicare taxes. This can be especially beneficial for a business that employs older workers, who can be subject to steeper tax rates.

Deductions and Credits

Deductions and credits are a major part of payroll tax planning. These deductions and credits reduce the amount of taxes a business owes. They include Social Security and Medicare taxes, federal unemployment insurance taxes, and the employer contribution to an employee’s Thrift Savings Plan or retirement account. The home office deduction and other business-related tax deductions are also common.

The frequency and amount of tax deductions depend on an employee’s marital status, pay rate, and allowances claimed. A single person with no children can usually have one budget, while married people with kids and higher pay rates may want to claim more.

Timing bonuses and compensation: Small businesses can reduce payroll taxes by paying bonuses or increased dividends in the following year rather than during the current one. Also, a company that uses the last-in, first-out inventory management method can lower its taxable earnings by using the LIFO tax rule.

Small business owners must adjust their deductions and credits as tax laws change. A professional accountant can help small businesses plan for these changes.

Seek Professional Help

While it may seem tempting to take on payroll taxes in-house, working with an accountant or financial professional is wise for businesses of any size. Accountants specialize in tax matters and stay up-to-date on current laws, ensuring that companies remain compliant while taking advantage of all available tax credits and deductions.

Aside from reducing the risk of mistakes that can cost your business money, working with an accountant or tax professional can also help you set up your business for success. They can help you determine the best way to structure your employee compensation, use automation software, and implement other methods for managing payroll taxes more effectively. They can even provide a checklist to ensure your year-end tasks are completed correctly, minimize tax liability, and meet reporting deadlines.

Remember that payroll taxes are one of the most significant costs for any small business. By adjusting your employee compensation structure, implementing automation, taking advantage of tax credits and deductions, staying current on current laws, and seeking professional help, you can reduce your payroll tax liability and save your small business money in the long run.